www.afterprime.com is operated by Afterpime Limited, a Securities Dealer authorised by the Financial Services Authority (“FSA”) of Seychelles with license number SD057.

Please be aware that our services are not available to persons or entities based in {$} .

In case you are an EEA/EU resident, and you would like to open a trading account with Afterprime Europe, please visit www.afterprime.eu .

If the above message is shown in error or if you already have an account with Afterprime Limited, you may proceed accordingly by clicking here .

Thank you for visiting www.afterprime.com

Please be aware that our services are not available to persons or entities based in {$} .

If the above message is shown in error or if you are not a resident of {$}, you may proceed accordingly.

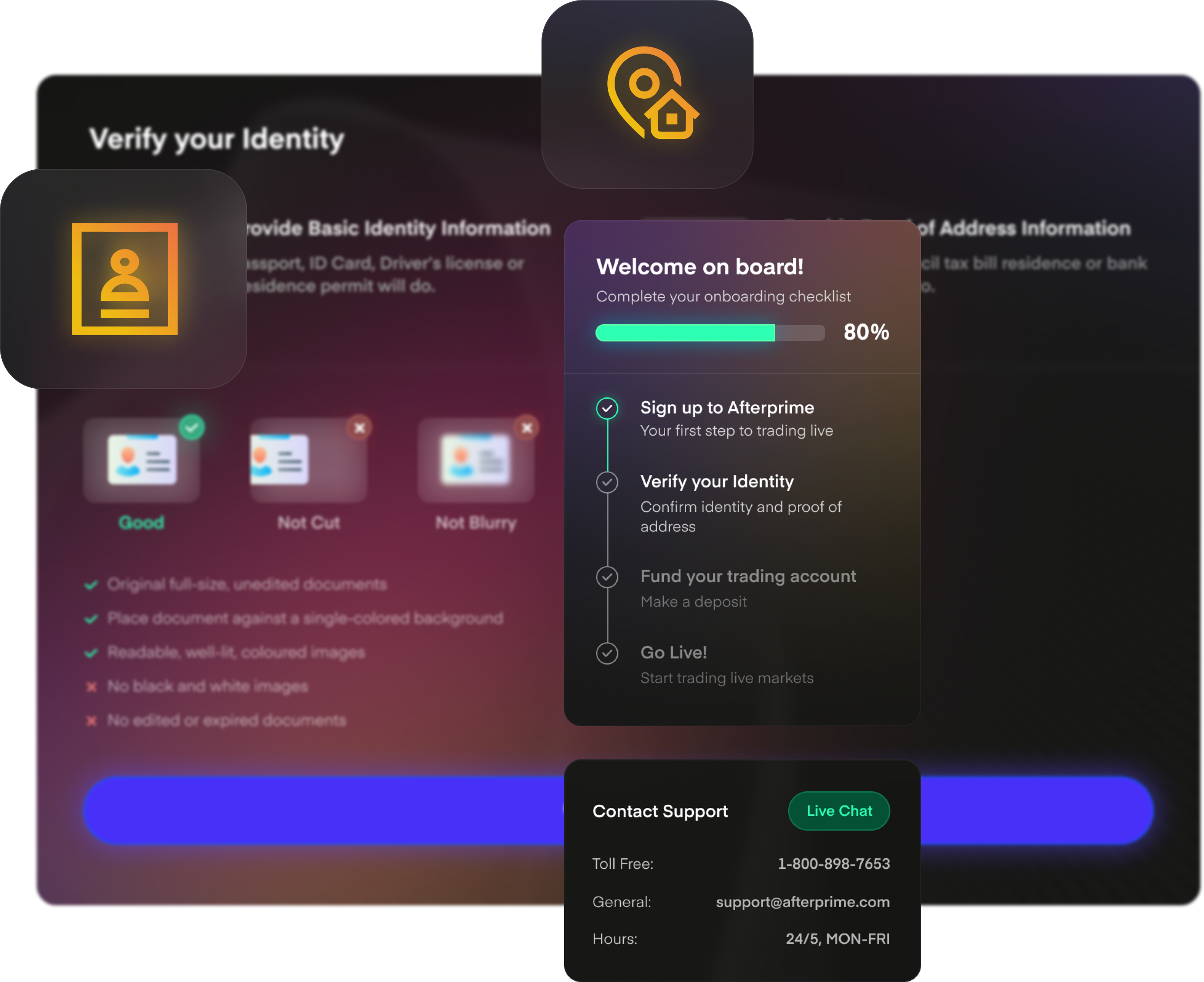

In accordance with the Anti-Money Laundering and Counter Terrorism Financing laws, we are required to verify your identity and current residential address prior to trading.

Your Primary ID must show full name and date of birth, and full name must match your application.

Passport | National ID | Driver's License

Bank or Credit Card Statement | Utility Bill | Government-Issued Document

Your Proof of Address must be issued within the last 120 days (6 months), and clearly show your full name and residential address. We can accept another form of primary ID but this must contain your residential address. Proof of ID must be valid for at least 6 months at the time of submission.

The Afterprime AML/CTF policy and procedures are focused around adherence to international guidelines that make sure your funds are held securely and our risk of facilitating criminal enterprise is minimized.

An individual trading account can be opened after providing a primary identification document such as drivers license or passport and one proof of address document such as a utility bill or bank statement.

Afterprime does not accept clients from:

Australia, USA, North Korea, Iran, Ontario (Canada), Ivory Coast, Russia, Ukraine and Puerto Rico.

Accounts are approved using a combination of electronic and manual verification and can be done in a few minutes if the details provided in your application and documents match. We aim to approve all customers as fast as possible and can help on live chat if you want to be approved immediately.

Afterprime may ask for additional documents from time to time in order to meet ongoing Anti-Money Laundering/Counter-Terrorism Financing obligations. This is perfectly normal for all financial institutions and may mean a bank statement or transfer slip as proof of funds, source of funds, or similar.

Test our platforms for free and jump into our Discord to see the magic unfold.

We look forward to supporting you on your trading journey.

Trading CFDs and FX is high risk and not suitable for all investors. Losses can exceed your initial investment. Any Information or advice contained on this website is general in nature and has been prepared without taking into account your objectives, financial situation, or needs. Our Risk Disclosures and Legal documents should be considered before deciding to enter into any derivative transactions.

The information on this site is not directed at residents of the following countries: Australia, United States, China, New Zealand, Japan, and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Afterprime Ltd (Seychelles company registration number 8426189-1) is a Securities Dealer, authorised by the Financial Services Authority (FSA) with licence number SD057. The registered office of Afterprime Ltd is 9A CT House, 2nd floor, Providence, Mahé, Seychelles.

Afterprime Ltd (BVI Company registration number 1519429) is authorised to provide financial technology and brokerage support services. The registered office of Afterprime Ltd is Portcullis Chambers, 4th Floor, Ellen Skelton Building, 3076 Sir Francis Drake Highway, Road Town, Tortola, British Virgin Islands VG1110.

Payment processing performed by SC Afterprime Limited a Cyprus incorporated company with registration number HE 615319 and registered office at Archiepiskopou Makariou ΙΙΙ, 160, 1st Floor, 3026, Limassol, Cyprus.

The entities above are duly authorised to operate under the Afterprime brand and trademarks.

© Copyright 2024 Afterprime. All rights reserved. All trademarks, service marks, trade names, trade dress, product names and logos appearing on the site are the property of their respective owners | Sitemap